Introduction to the Cashflow Quadrant

Person A (Curious Learner): Hey, I've been hearing a lot about this "Cashflow Quadrant" by Robert Kiyosaki. Can you explain what it's all about?

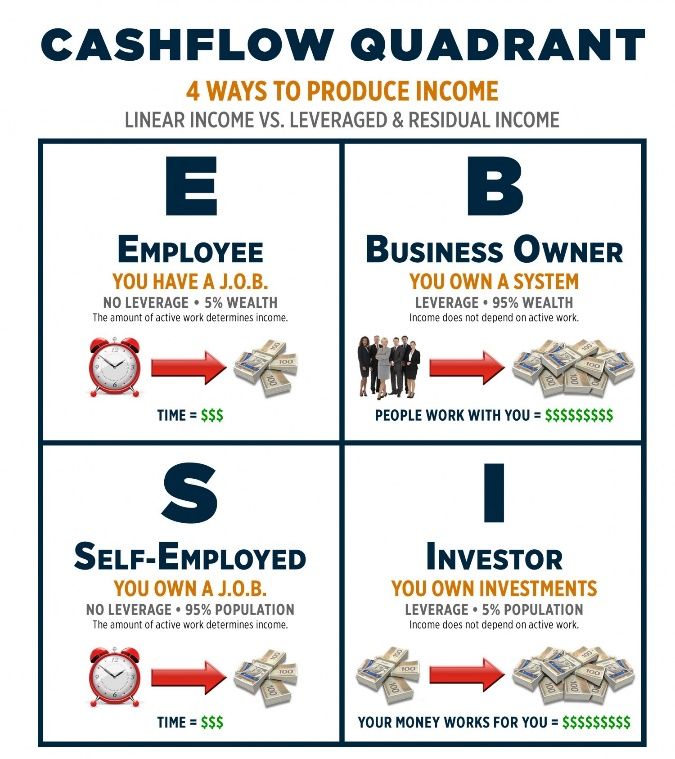

Person B (Financial Enthusiast): Sure! The Cashflow Quadrant is a concept introduced by Robert Kiyosaki in his book "Rich Dad's CASHFLOW Quadrant." It's essentially a framework that categorizes the different ways people earn income, divided into four quadrants: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I).

Person A: That sounds interesting. Can you break down each quadrant for me?

Person B:

Absolutely. Here's a brief overview:

- Employee (E): People in this quadrant work for someone else. They earn income through a salary or wages. This is the most common and traditional way of earning a living.

- Self-Employed (S): These individuals work for themselves. They might be freelancers, consultants, or small business owners. While they have more control over their work, they often exchange time directly for money.

- Business Owner (B): Business owners build systems and leverage other people's time and skills to generate income. They don't necessarily work in the business day-to-day but rather on the business, focusing on growth and expansion.

- Investor (I): Investors make their money work for them. They invest in assets like stocks, real estate, or businesses, aiming to generate passive income.

Application in Today's World

Person A: How does this concept apply in today's world?

Person B: The Cashflow Quadrant is highly relevant today, especially with the evolving nature of work and the increasing opportunities for entrepreneurship and investment. Let's look at each quadrant in the context of today's economy:

- Employee (E): The traditional job market is changing with the rise of remote work and the gig economy. While job security can be a concern, employees now have more flexibility and opportunities to find roles that align with their passions and skills.

- Self-Employed (S): Technology has made it easier than ever to start a business or offer freelance services. Platforms like Upwork, Fiverr, and Etsy allow individuals to monetize their skills and passions. However, self-employed individuals must manage their own benefits and taxes, and work-life balance can be challenging.

- Business Owner (B): Entrepreneurship is thriving, with numerous resources available for aspiring business owners, from online courses to startup incubators. The digital economy allows for scaling businesses with relatively low overhead, especially in areas like e-commerce, SaaS, and digital marketing.

- Investor (I): With the rise of online trading platforms, real estate crowdfunding, and cryptocurrencies, investing is more accessible than ever. People can start investing with small amounts of money and gradually build their portfolios.

Using the Quadrant for Future Plans

Person A: How can someone use the Cashflow Quadrant to plan for their future?

Person B:

Great question! Here are some steps you can take to utilize the Cashflow Quadrant in planning your future:

- Assess Your Current Position: Identify which quadrant you currently belong to. This will help you understand your starting point and the type of income you're currently earning.

- Set Goals: Determine where you want to be in the future. Do you want to move from being an employee to a business owner or an investor? Setting clear financial and career goals is crucial.

- Acquire Skills and Knowledge: Each quadrant requires different skills. If you want to transition from being self-employed to a business owner, you might need to learn about business management, leadership, and scaling operations. For investing, financial literacy and market knowledge are key.

- Take Calculated Risks: Moving quadrants often involves taking risks. For example, starting a business or investing in the stock market. It's important to make informed decisions and not rush into anything.

- Leverage Technology:

Use modern tools and resources to your advantage. Whether it's online courses, financial apps, or networking platforms, technology can provide you with the support and knowledge you need to succeed.

Passion and Drive

Person A: How do passion and drive fit into this framework?

Person B: Passion and drive are critical components of success, no matter which quadrant you're in. Here’s how they come into play:

- Employee (E): Find a job that aligns with your passions. This will make your work more fulfilling and increase your chances of excelling and moving up the career ladder.

- Self-Employed (S): When you're passionate about what you do, it's easier to handle the challenges of being self-employed. Your drive will help you stay motivated and find innovative ways to grow your business.

- Business Owner (B): Passion is crucial for business owners. It keeps you committed during tough times and inspires your team. Your drive to see your vision come to life can be a powerful motivator.

- Investor (I): Successful investing often requires patience and a keen interest in understanding markets and financial instruments. If you're passionate about investing, you'll be more inclined to stay informed and make better decisions.

Real-Life Application and Examples

Person A: Can you give some real-life examples of people using the Cashflow Quadrant concepts?

Person B: Sure! Here are a few examples:

- Employee to Business Owner: Sara Blakely, the founder of Spanx, started as an employee selling fax machines. Her entrepreneurial spirit and passion for fashion led her to create Spanx, transforming her into a successful business owner.

- Self-Employed to Investor: Tim Ferriss, the author of "The 4-Hour Workweek," started as a self-employed entrepreneur. He later invested in startups like Uber and Twitter, moving into the Investor quadrant and generating substantial passive income.

- Business Owner to Investor: Elon Musk, known for founding companies like Tesla and SpaceX, also invests heavily in other ventures. His ability to leverage business ownership into significant investment opportunities showcases a transition between quadrants.

Practical Steps for Individuals

Person A: How can the average person start applying these concepts in their daily life?

Person B: Here are some practical steps anyone can take:

- Financial Education: Start by educating yourself about personal finance, investing, and entrepreneurship. Books, podcasts, and online courses are great resources.

- Side Hustles: Consider starting a side hustle that aligns with your passions. This can help you transition from the Employee to Self-Employed quadrant.

- Networking: Build a network of like-minded individuals. Networking can provide support, mentorship, and opportunities as you move between quadrants.

- Budgeting and Saving: Practice good financial habits. Budgeting and saving can provide the capital needed to invest or start a business.

- Investing Small: Begin investing with small amounts. Use platforms that allow fractional investing to build your confidence and knowledge.

Conclusion

Person A: Thanks for the detailed explanation! The Cashflow Quadrant seems like a powerful tool for understanding and planning our financial futures.

Person B: You're welcome! It really is. By understanding where you are and where you want to go, you can make more informed decisions and leverage your passion and drive to achieve your financial goals. Remember, it's a journey, and every step you take brings you closer to financial independence and fulfillment.