The Lifeblood of Prosperity

The Critical Importance of Cash Flow: In Business, Personal Life, and Beyond

When you hear the term “cash flow,” your mind may immediately jump to business finances.

While that’s a vital part of the conversation, the principles of cash flow go far beyond balance sheets and profit margins. Cash flow impacts every aspect of our lives, from our ability to manage daily expenses to planning for retirement and even our access to life’s most basic needs.

In this newsletter, we explore why cash flow is as essential to life as oxygen and why executing a plan today is the key to thriving in an unpredictable world.

What Is Cash Flow, and Why Does It Matter?

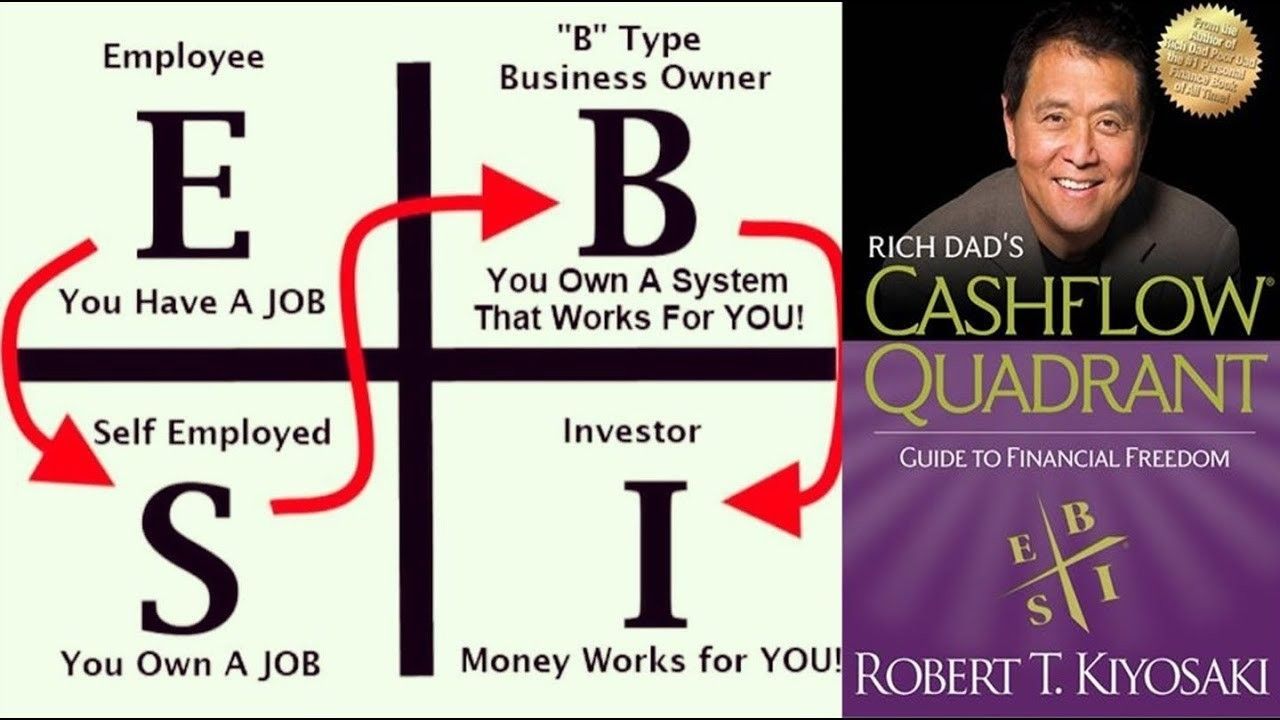

Cash flow refers to the movement of money in and out of a system. For businesses, it’s the inflow from sales and investments versus the outflow for expenses and liabilities. For individuals, it’s your income versus your expenditures.

Here’s why cash flow matters across all domains:

✅ For Personal Finance: Cash flow determines your ability to pay bills, save for emergencies, and invest in the future. Poor cash flow management can lead to mounting debt and financial stress.

✅ For Business: Positive cash flow is the lifeline of a business. It enables growth, sustains operations, and ensures the company can weather economic downturns.

✅ For Retirement: Your retirement depends not just on the size of your savings but also on how well you can manage those funds to ensure consistent income.

✅ For Life Itself: Just as oxygen fuels our bodies, cash flow fuels our lives. A lack of oxygen leads to suffocation, and a lack of cash flow leads to financial collapse.

The Ripple Effect of Poor Cash Flow Management

Without intentional cash flow management, the consequences can be devastating. Here are a few ways it can spiral:

👉 Personal Stress: Living paycheck to paycheck is emotionally draining and limits your ability to enjoy life.

👉 Business Failure: Many businesses fail not because they aren’t profitable but because they run out of cash to cover short-term liabilities.

👉 Retirement Shortfalls: Waiting too long to plan for retirement leaves many people unable to maintain their quality of life in their later years.

👉 Missed Opportunities: Poor cash flow management means you can’t take advantage of opportunities like investments, business expansions, or education.

Strategies for Improving Cash Flow Today

The good news? Cash flow isn’t an abstract concept—it’s a controllable factor in your life.

Here are actionable strategies to improve your cash flow starting today:

Personal Finances

✅ Create a Budget: Understand where your money goes by categorizing your income and expenses. Identify areas where you can cut back.

✅ Build an Emergency Fund: Aim for at least three to six months of living expenses in an easily accessible account.

✅ Eliminate High-Interest Debt: Focus on paying off debts with the highest interest rates first to free up future cash flow.

✅ Increase Your Income: Take up a side hustle, invest in skills that boost your earning potential, or monetize hobbies.

Business Finances

✅ Monitor Cash Flow Regularly: Use cash flow statements to track your inflow and outflow. Understand your break-even point.

✅ Negotiate Payment Terms: Work with suppliers and customers to improve the timing of payments, ensuring you’re not caught short.

✅ Streamline Operations: Evaluate and cut unnecessary expenses without compromising quality or customer satisfaction.

✅ Invest in Growth: Use surplus cash to invest in areas that generate additional income streams.

Retirement Planning

✅ Start Early: Even small, consistent contributions to retirement accounts like a 401(k) or IRA can grow significantly over time.

✅ Diversify Income Streams: Consider rental properties, dividends, or part-time work in retirement to supplement your savings.

✅ Understand Withdrawal Rates: A sustainable withdrawal rate, such as 4% annually, can help your retirement savings last.

✅ Consult a Financial Planner: Seek professional advice to create a plan tailored to your retirement goals.

Why You Need to Act Today

Many people fall into the trap of thinking they have plenty of time to “get it together.” The reality? Time is not on our side.

The two things we cannot control—time and death—continue to move forward, regardless of our plans.

Waiting to act is akin to holding your breath and hoping you won’t need oxygen. Life doesn’t work that way. By taking deliberate action today, you’re ensuring that your future isn’t left to chance.

Facing Reality: The World We Live In

The world is in constant flux. Economic shifts, technological advancements, and unforeseen global crises can all affect our financial stability.

✅ Inflation: Your money’s purchasing power decreases over time.

✅ Economic Uncertainty: Recessions, layoffs, and market volatility are realities we must prepare for.

✅ Longevity: People are living longer, which requires more careful planning for long-term financial sustainability.

By preparing for these uncertainties today, you’re safeguarding your future.

The Hard Truth: Most People Are Unprepared

It’s estimated that 99% of people are strolling through life without a plan, believing they have more time than they actually do. This lack of urgency can have catastrophic effects when unexpected events arise.

Don’t be part of that 99%. Recognize the importance of cash flow now. Take action to secure your financial future and, by extension, your peace of mind.

A Final Thought: Cash Flow and Oxygen

Consider this: Without oxygen, your body cannot function.

Similarly, without cash flow, your life’s plans cannot thrive. Prioritizing your financial health isn’t just a good idea; it’s essential for survival.

Today is the day to execute a plan. Whether it’s creating a budget, starting a side hustle, streamlining business operations, or setting up a retirement account, every action you take today builds a stronger foundation for tomorrow. Remember, the clock is ticking. Time and death wait for no one. But with intentional cash flow management, you can make the most of the time you have.

Your Next Steps:

✅ Evaluate your current cash flow situation.

✅ Set clear goals for personal, business, and retirement finances.

✅ Take immediate action to address any areas of concern.

✅ Stay proactive and adaptable as the world evolves.

Let today be the day you stop strolling and start thriving.

Stay informed. Stay prepared. And always keep your cash flow strong.

If I can help in any areas of giving a FREE Evaluation of your concerns and seeing if their are areas that we can offer solutions please feel free to connect:

Schedule A Call: Click Here

Learn More About Our Diversified Services and Resources with Manfre and Associates Consulting Services. CLICK HERE

Business Advisory / Insurance / Real Estate / Marketing Solutions

BUILD YOUR BRAND THROUGH OUR AFFILIATE pLATFORM

Give us a call today

Phone Number: (504) 344-3317

Send us an Email today

Email: manfreconsulting@gmail.com

All Rights Reserved | Manfre And Associates Consulting Services