Your Life is a Business – Operate It Like One 📊💡

Why You Must Run Your Life Like a Business

Most people go through life reacting rather than strategizing.

But what if you started treating your personal finances the same way a successful CEO runs a business?

The difference between financial security and struggle often comes down to understanding the key principles of business and applying them to your life.

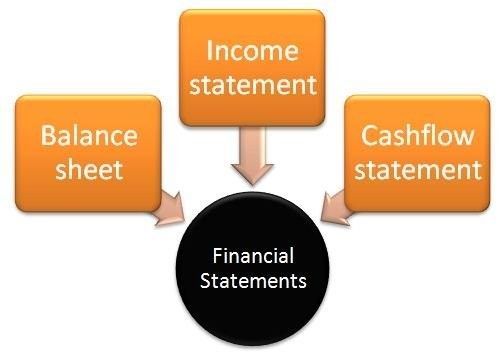

1. Understanding Your Personal Financials 💰📑

In business, financial reports determine success. The same should apply to your personal life.

Here’s what you need to track:

✔ Income (Revenue): All sources of earnings, including salary, side hustles, and investments.

✔ Expenses (Overhead): Fixed and variable costs such as rent, utilities, food, and entertainment.

✔ Net Profit: The amount left after expenses. Are you running a surplus or operating at a loss?

✔ Budgeting Strategies: Use apps like Mint, YNAB, or spreadsheets to track every dollar.

✔ Emergency Fund: Maintain at least 3-6 months of expenses in a high-yield savings account.

📌 Strategy: Conduct a monthly financial review, just like a business evaluates its quarterly earnings. Identify wasteful spending and optimize cash flow.

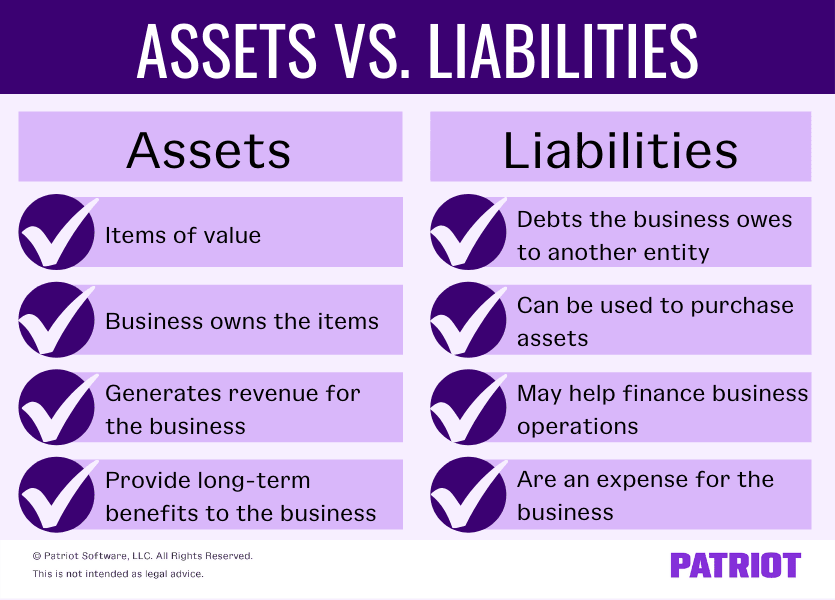

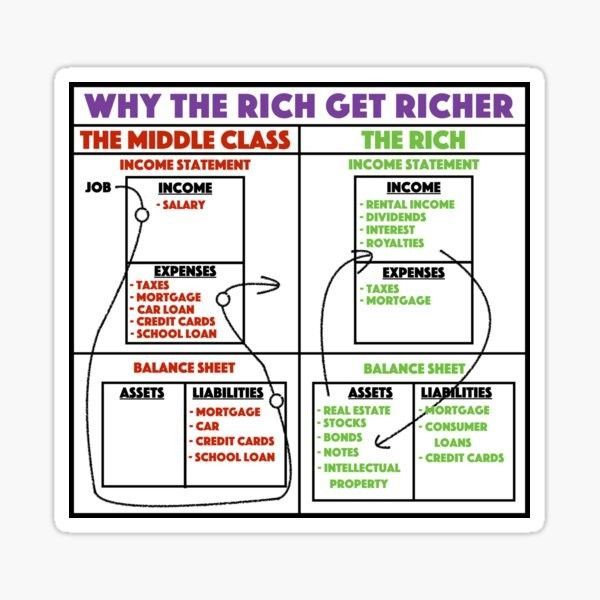

2. Assets vs. Liabilities – Build, Don’t Drain 📈⚖️

A business invests in income-generating assets. You should do the same!

🟢 Assets (Income-Producing)

✔ Rental properties 🏡

✔ Dividend-paying stocks 📈

✔ Online businesses 💻

✔ Intellectual property (e.g., books, courses) 📚

✔ High-yield savings accounts 💵

✔ REITs & Index funds 🔄

🔴 Liabilities (Expense-Generating)

✖ Cars (unless used for income, like ridesharing) 🚗

✖ Credit card debt 💳

✖ Unnecessary luxury purchases 🛍️

✖ Depreciating assets (trendy gadgets, high-end fashion) 👜

📌 Strategy: Shift spending from liabilities to assets. Before any purchase, ask: “Will this generate or drain my wealth?”

3. Profit & Loss Statement – Know Where You Stand 📊📉

Just like a business, you should create a personal Profit & Loss (P&L) statement:

✔ Income Sources: Salary, bonuses, rental income, dividends.

✔ Fixed Expenses: Rent, mortgage, insurance, loan payments.

✔ Variable Expenses: Dining out, entertainment, shopping.

✔ Investment Contributions: 401(k), Roth IRA, brokerage accounts.

✔ Debt Repayments: Credit cards, student loans.

✔ Net Profit: Your savings and investments after all deductions.

📌 Strategy: Automate savings and investments to ensure positive cash flow and wealth accumulation.

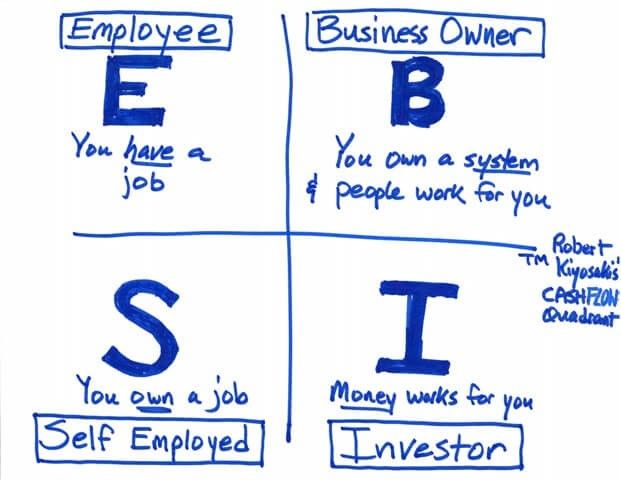

4. Creating Cashflow Machines – Your Key to Wealth 🔄💸

Wealthy businesses don’t rely on a single source of income. Neither should you!

💡 Best Cashflow Strategies:

✔ Real Estate Investments – Rental properties create passive income.

✔ Dividend Investing – Build a portfolio that pays you regularly.

✔ Automated Online Businesses – Digital courses, e-books, affiliate marketing.

✔ Side Hustles That Scale – Freelancing, consulting, or creating an agency.

✔ Licensing & Royalties – Own intellectual property that generates long-term revenue.

✔ Peer-to-Peer Lending & Crowdfunding – Invest in alternative finance markets.

📌 Strategy: Build at least three income streams, ensuring some are passive (money works for you without daily effort).

5. The 3rd & 4th Quarter of Life – Prepare, Learn, Execute ⏳📖

As we enter the later stages of life, financial preparation becomes even more critical. You must have a wealth-building plan in place.

✔ Prepare:

- Evaluate retirement accounts (IRA, 401(k), SEP-IRA).

- Establish a tax-efficient withdrawal strategy.

- Eliminate bad debt before retirement.

✔ Learn:

- Study real estate, stock investing, and passive income strategies.

- Follow financial experts and take wealth-building courses.

- Master tax advantages to minimize liabilities.

✔ Execute:

- Invest aggressively in income-producing assets.

- Set up estate planning (wills, trusts, healthcare directives).

- Automate wealth accumulation through long-term investments.

📌 Strategy: Your future self depends on the decisions you make TODAY. Don’t delay financial planning.

Final Takeaway – Think Like a CEO! 🚀🏆

A well-run business plans for long-term success. Your life should be no different.

✔ Track income and expenses like a CFO.

✔ Invest in assets that generate passive income.

✔ Continuously optimize your personal financial strategies.

✔ Create multiple cashflow machines to achieve true financial independence.

✔ Execute your financial plan NOW – not later.

Are you operating your life like a thriving business, or are you just getting by?

Now’s the time to take control, build wealth, and ensure long-term financial freedom.

🚀 Let’s execute and create our own cashflow machines! 💰💡

Join Our Community To Learn, Grow, Monetize Faster: CLICK HERE

Learn More of How We Can Help You Achieve Your Financial Goals:

CLICK HERE

BUILD YOUR BRAND THROUGH OUR AFFILIATE pLATFORM

Give us a call today

Phone Number: (504) 344-3317

Send us an Email today

Email: manfreconsulting@gmail.com

All Rights Reserved | Manfre And Associates Consulting Services